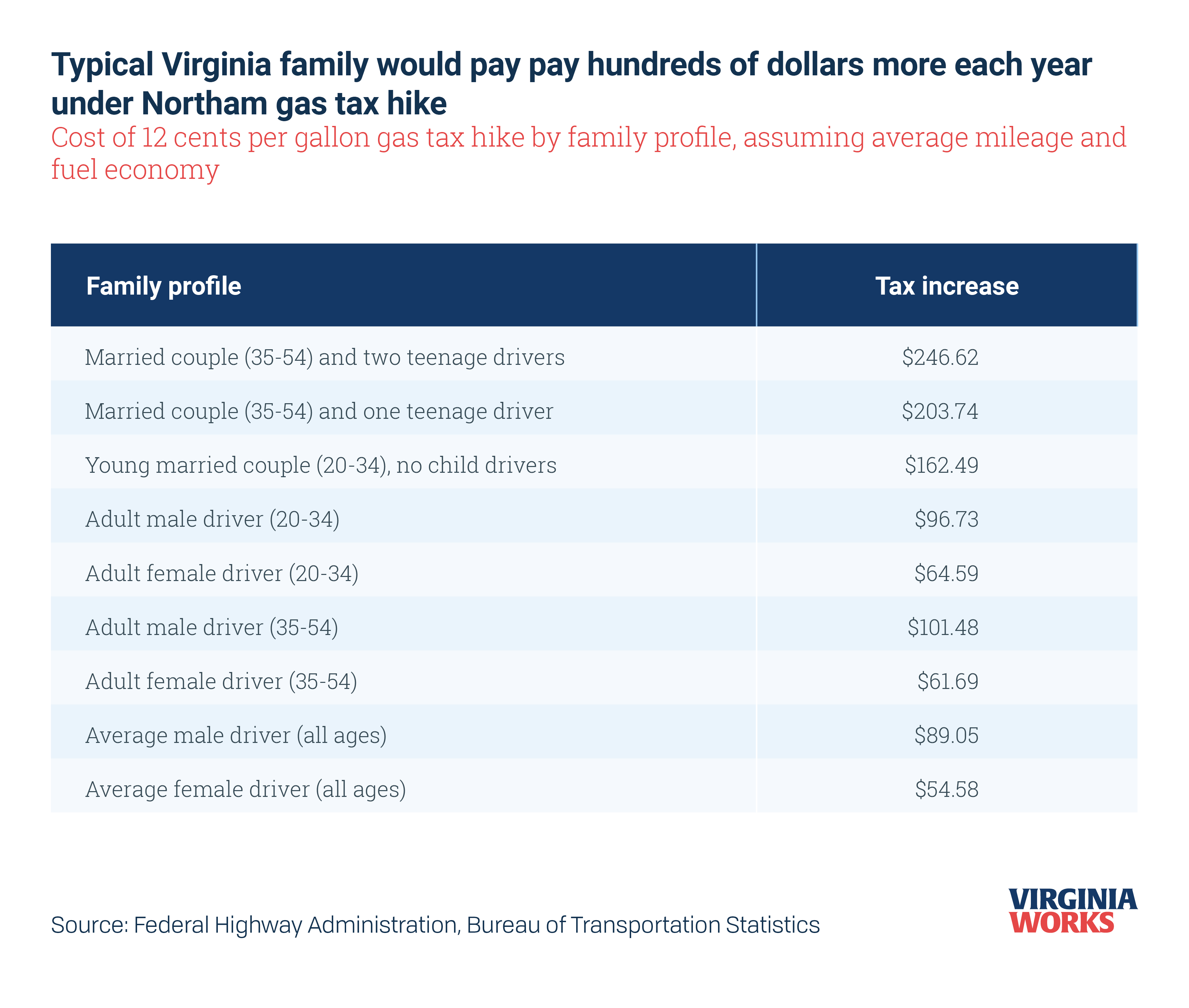

Northam gas tax hike would cost typical Virginia family nearly $250 a year

Virginia drivers would see a $491 million gas tax hike under a proposal from Gov. Ralph Northam.

Passenger vehicles drive a combined 80 billion miles across nearly 58,000 miles of Virginia roads every year. And the state’s transportation policy has historically focused on maintaining that road infrastructure. But the ground might be shifting under Virginia’s drivers – along with the taxes they pay.

Gov. Ralph Northam and his allies in the General Assembly are championing a gas tax hike of 12 cents per gallon. It would be phased in 4 cents at a time over three years, ultimately bringing the gas tax from 22 to 34 cents per gallon, an increase of more than 50%.

Assuming average mileage and fuel economy, this gas tax hike would cost a family with two teenage drivers almost $250 a year more, a couple with one teenage driver over $200 a year in additional taxes, and about $75 a year in higher gas taxes on a typical adult motorist.

Will higher gas taxes fix roads?

If the additional revenue were earmarked for road spending, some drivers might grin and bear it. No such luck: gas tax increases in Virginia have a history of being siphoned off for other projects, and the connection between motor fuel taxes and road funding exists more on paper than in reality.

There’s no guarantee the additional money – a $491 million tax increase – will go to roads.

Some gas tax revenue goes to mass transit and policymakers’ pet projects, and in an economic downturn, lawmakers might even sweep the money into the general fund. Meanwhile, in addition to the Commonwealth’s share of federal transportation dollars, some road funding is drawn from the sales tax.

It’s possible to imagine a plan that raises the gas tax while cutting the sales tax, shifting more of the burden of road funding to those using the roads. That’s not what Northam’s plan proposes. There’s no offset anywhere else in the tax code.

There are some silver linings for drivers in the governor’s budget proposal, like ending an inspection requirement that doesn’t make driving any safer, but there’s no need to hold the repeal of an ineffective policy hostage to a nearly $500 million tax increase. Additionally, a proposed reduction in vehicle license fees does not come close to offsetting the higher gas tax.

In short, the gas tax hike proposal is a revenue grab. And the motivation may be hidden in plain sight: to discourage driving.

Under Northam, Virginia has joined both the Regional Greenhouse Gas Initiative, or RGGI, and the Transportation Climate Initiative, or TCI, pledging to cap carbon emissions from both power plants (the RGGI) and transportation (the TCI). The TCI contemplates requiring fuel wholesalers to buy credits for the gasoline they sell, driving up the cost of gas in the state. Perhaps as an opening bid, the Northam administration would like a gas tax increase. It operates as a twofer, raising revenue by increasing the cost of driving.

When designed as a user fee, gas taxes are intended to pay for roads. Designed as a “sin tax,” a gas tax increase becomes about getting people off the roads. Instead of easing congestion in Northern Virginia or along the I-81 corridor, abiding by TCI priorities would mean diverting funding to mass transit, bike paths, electric vehicle charging stations and other wish list items that don’t benefit Virginians for whom driving is a necessity.

It’s one thing to ask people to pay for the roads they use; it’s another to ask them to pay for the infrastructure they don’t use, or to be penalized for driving a car, particularly in a state as large and diverse as Virginia.

Virginia is the only southern state to join the TCI. And if Northam gets his way, Virginia drivers will be paying more at the pump even before the TCI’s more aggressive policies are implemented, without any assurances that the money will go toward the improvement of the roads they use.

That the gas tax could go up more than 50% is troubling enough. What should really worry Virginians is the prospect that it’s just a down-payment on even more burdensome policies down the road.